Planting & Harvest Windows — The Hidden Market Rhythm

Category: Knowledge • Seasonality & Commodities

Website: cot-trader.com

Seasonality in commodity markets is not just a statistical coincidence. It is rooted in the biological and operational realities of agriculture. Every major crop follows a predictable cycle: Planting → Growing Season → Weather Risk → Harvest → Demand Phase. This hidden agricultural rhythm drives price behaviour in markets such as Corn, Wheat, Soybeans, Sugar, Coffee, Cotton, and Cocoa.

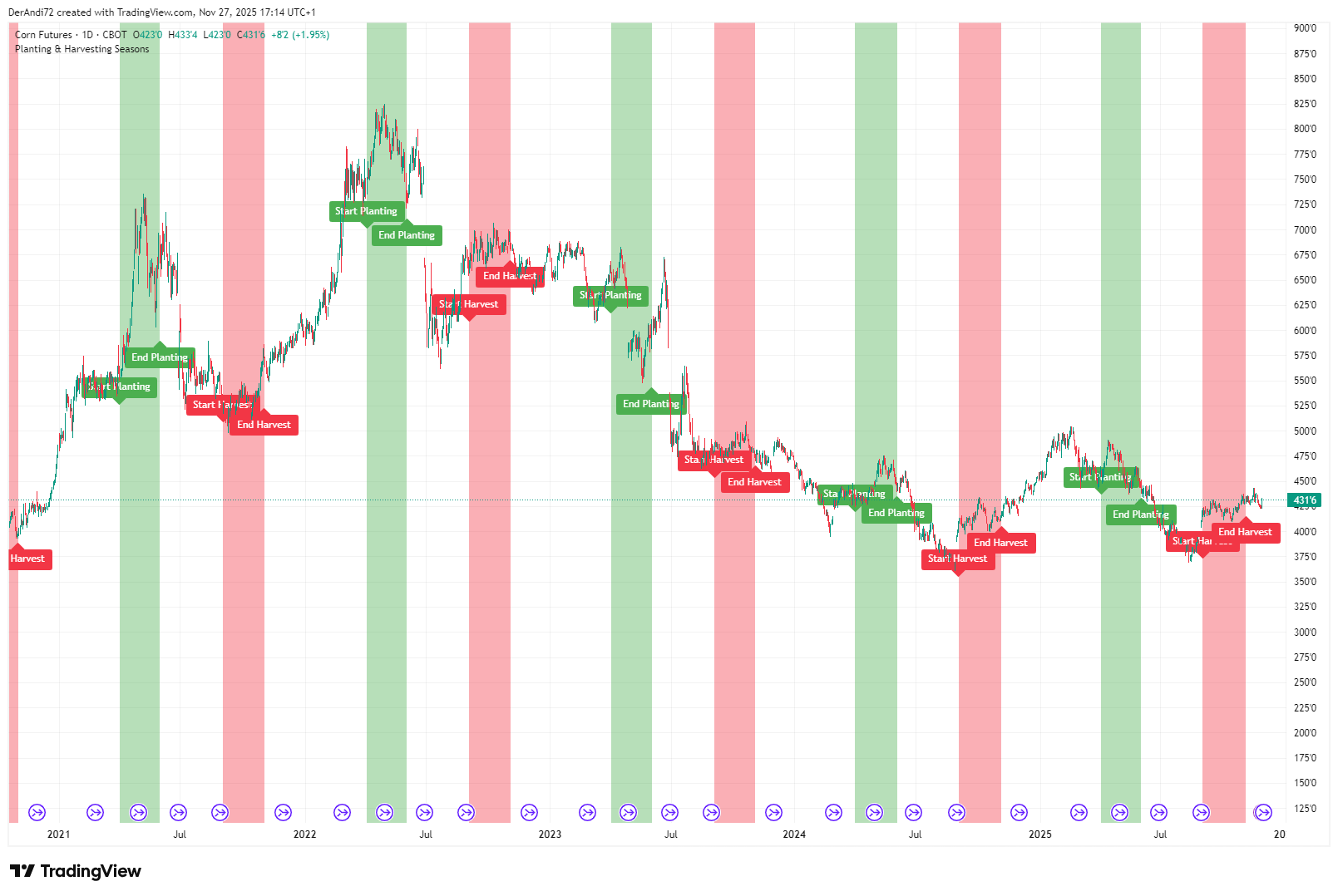

Understanding these seasonal windows provides futures traders with a structural advantage: volatility clusters, hedging flows, supply cycles, and repeating price tendencies. This article explains these dynamics and introduces the Planting & Harvest Script available on cot-trader.com, which visualises these cycles directly in TradingView.

1. Why Planting & Harvest Windows Matter

Agricultural markets are driven by biology. Unlike equity indices or currencies, crop markets move in direct response to planting progress, weather, crop development, harvest timing, and physical supply flow.

- Planting: uncertainty, acreage decisions, weather risk

- Growing Season: rainfall, drought, temperatures, crop conditions

- Pre-Harvest: yield risk and volatility spikes

- Harvest: physical supply enters the market (pressure)

- Post-Harvest: demand normalisation and seasonal rallies

These phases create recurring patterns every single year — a rhythm that commodity traders must understand.

2. The Market Rhythm: From Planting to Harvest

The high-level agricultural cycle follows a consistent structure:

- Planting Window: markets price uncertainty and weather risk

- Growing Season: weather becomes the dominant catalyst

- Pre-Harvest Volatility: markets react strongly to yield threats

- Harvest: supply pressure as crops reach storage and processing

- Demand Phase: end-users step in, spreads normalise

This cycle repeats every year with remarkable reliability and is visible in long-term charts and seasonal models.

3. Full Table: Planting & Harvest Windows for Major Commodities

| Commodity | Exchange | Planting Window | Harvest Window | Notes |

|---|---|---|---|---|

| Corn (ZC) | CME | Mid-Apr → Mid-May | Late Sep → Mid-Nov | Highly weather-sensitive; strong planting volatility. |

| Soybeans (ZS) | CME | Late Apr → Mid-Jun | Early Oct → Late Nov | Rainfall-dependent; strong seasonal trends. |

| Soybean Meal (ZM) | CME | Inherits ZS cycle | Inherits ZS cycle | Often leads Soybean Oil in volatility. |

| Soybean Oil (ZL) | CME | Inherits ZS cycle | Inherits ZS cycle | Strongly linked to biodiesel markets. |

| Wheat – Winter (ZW) | CME | Sep → Oct | Jun → Jul | Represents ~70% of US wheat production. |

| Wheat – Spring (MW) | MGEX | Apr → May | Aug → Sep | More volatile; northern regions. |

| Cotton (CT) | ICE | Mar → Jun | Sep → Dec | Weather and insect-pressure driven. |

| Sugar (SB) | ICE | Sep → Dec | Feb → Jun | Dominated by Brazil & India production cycles. |

| Coffee (KC) | ICE | Oct → Mar (flowering) | May → Sep (main harvest) | Highly weather-sensitive (frost risk). |

| Cocoa (CC) | ICE | Oct → Jan (flowering) | Feb → May (main), Sep → Dec (mid) | Two seasonal crops; complex pattern. |

4. How Traders Use These Seasonal Windows

- Seasonal price tendencies (e.g., post-harvest rallies)

- Commercial hedging cycles from producers and processors

- Weather-driven volatility clusters

- Calendar spreads driven by storage and carry

- Event-driven trading (WASDE, Crop Progress)

These windows explain many of the structural tendencies visible in long-term Futures charts.

5. TradingView Script Integration

The Planting & Harvest Script for TradingView visualises these seasonal zones directly inside the chart. It includes:

- Automatic symbol recognition via

syminfo.root - Accurate planting/harvest windows per commodity

- Color-coded seasonal highlights

- Pepperstone CFD compatibility

- Optional CSV import (Seasonax, InsiderWeek)

Below is a sample screenshot placeholder:

6. Practical Use Cases for Traders

- Corn & Soybeans: weather rallies in June/July, harvest lows in autumn

- Wheat: winter vs. spring cycles, geopolitical sensitivity

- Softs: dual-harvest structures (Cocoa, Coffee), strong weather risk

- Spread Traders: storage carry, basis effects, intermonth volatility

7. Conclusion

Planting and harvest cycles are not optional knowledge — they are the foundation of price behaviour in agricultural markets. With the TradingView Planting & Harvest Script, traders can visualise this hidden rhythm directly on their charts, gaining a structural edge that repeats every year.

Source: USDA, CME, ICE, NOAA, crop progress reports.